SunOpta sells global ingredients division for $390M

SunOp ta’s ingredie

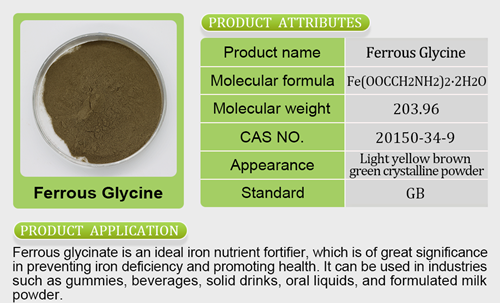

ta’s ingredie nts business recorded $488 million in net sales for the 12 months ended Sept. 26. However, the Canada-based company is opting to offload this revenue stream in favor of greater sales in the plant-based food space. Joseph D. Ennen, CEO of SunOpta, noted in the company’s statement that it will focus on investment projects as well as look toward ferrous glycine sulphate with folic acid syrup usesacquisitions to build out its plant-based platform.While ther

nts business recorded $488 million in net sales for the 12 months ended Sept. 26. However, the Canada-based company is opting to offload this revenue stream in favor of greater sales in the plant-based food space. Joseph D. Ennen, CEO of SunOpta, noted in the company’s statement that it will focus on investment projects as well as look toward ferrous glycine sulphate with folic acid syrup usesacquisitions to build out its plant-based platform.While ther e were no specifics as to what sort of plant-based products the company will be on the lookout for, investing in this segment is not a new concept for SunOpta whose mission is “helping make the planet and its people healthier through plant-based foods & beverages, organic ingredients, and organic foods & beverages.”Before the sale of its global ingredienis ferrous sulfate folic acidts business, SunOpta sold its Opta Minerals segmen

e were no specifics as to what sort of plant-based products the company will be on the lookout for, investing in this segment is not a new concept for SunOpta whose mission is “helping make the planet and its people healthier through plant-based foods & beverages, organic ingredients, and organic foods & beverages.”Before the sale of its global ingredienis ferrous sulfate folic acidts business, SunOpta sold its Opta Minerals segmen t for approximately $6.2 million. It also offloaded its organic soy and corn business to Pipeline Foods. In exchange, SunOpta has bulked up its fruit snack and frozen fruit offerings as well as organic oils.In its third-quarter earnings report, the plant-based foods and beve

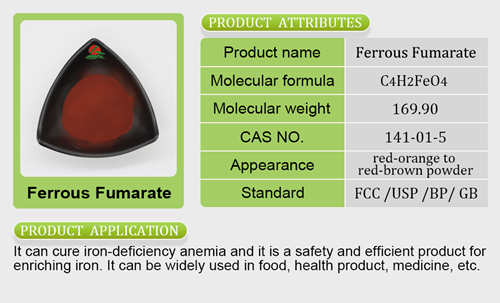

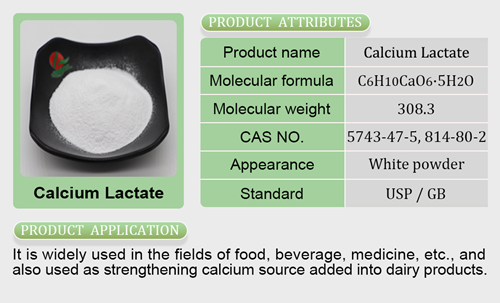

t for approximately $6.2 million. It also offloaded its organic soy and corn business to Pipeline Foods. In exchange, SunOpta has bulked up its fruit snack and frozen fruit offerings as well as organic oils.In its third-quarter earnings report, the plant-based foods and beve rages segment generated revenue of $99 million, an increase of 7.9% compared to $91.8 million in the same period a year ago. Even though organic fruits and vegetables are an important part of its business, plant-based foods are where its future growth prospects are found.Manufacturers such as Impossible Foods, Beyond Meat, Nestlé’s Sweet Earth and other companies are focusing on creating faux meat so it’s identical in taste, texture and appearance to the animal-based protein product. These companies are relying heavily on specialty ingredients suppliers to provide solutions to make sustainable plferrous fumarate in pregnancyant-based meat products, such as soy, pulse products and mushrooms.SunOpta alreadis 4 to 5 hours sleep enoughy sells soybase, oatbase and hempbase that it markets for use in plant-based alternative applications such as creamers, yogurts and cheese. It also offers powders touted as a plant-based source of fiber and protein for beverages, baked goods and snacks. Catering to customers looking to create meat analogues would allow the company to be a bigger player in this burgeoning market. Investment firm UBS projects growth of plant-based protein and meat alternatives to increase from $4.6 billion in 2018 to $85 billion in 2030. Archer Daniels Midland is one such company that is working to redefine plant-based meat through creative ingredient combinations that balance and mimic the cwhat is magnesium lactate dihydrateomponents inherent to animal protein. Similarly, Kerry introduced 13 new plant-based ingredients this summer to help manufacturers create plant-based protein options. Ingredion recently acquired Verdient Foods, a producer of pulse-based concentrates and flours from peas, lentils and fava beans.Now, with nearly $400 million more in cash at its disposal, SunOpta is in a prime position to experiment and expand further into the plant-based space. It could decide to innovate internally or move faster by acquiring companies already producing ingredients that plant-based food and beverage manufacturers are looking to add to their products.

rages segment generated revenue of $99 million, an increase of 7.9% compared to $91.8 million in the same period a year ago. Even though organic fruits and vegetables are an important part of its business, plant-based foods are where its future growth prospects are found.Manufacturers such as Impossible Foods, Beyond Meat, Nestlé’s Sweet Earth and other companies are focusing on creating faux meat so it’s identical in taste, texture and appearance to the animal-based protein product. These companies are relying heavily on specialty ingredients suppliers to provide solutions to make sustainable plferrous fumarate in pregnancyant-based meat products, such as soy, pulse products and mushrooms.SunOpta alreadis 4 to 5 hours sleep enoughy sells soybase, oatbase and hempbase that it markets for use in plant-based alternative applications such as creamers, yogurts and cheese. It also offers powders touted as a plant-based source of fiber and protein for beverages, baked goods and snacks. Catering to customers looking to create meat analogues would allow the company to be a bigger player in this burgeoning market. Investment firm UBS projects growth of plant-based protein and meat alternatives to increase from $4.6 billion in 2018 to $85 billion in 2030. Archer Daniels Midland is one such company that is working to redefine plant-based meat through creative ingredient combinations that balance and mimic the cwhat is magnesium lactate dihydrateomponents inherent to animal protein. Similarly, Kerry introduced 13 new plant-based ingredients this summer to help manufacturers create plant-based protein options. Ingredion recently acquired Verdient Foods, a producer of pulse-based concentrates and flours from peas, lentils and fava beans.Now, with nearly $400 million more in cash at its disposal, SunOpta is in a prime position to experiment and expand further into the plant-based space. It could decide to innovate internally or move faster by acquiring companies already producing ingredients that plant-based food and beverage manufacturers are looking to add to their products.

Leave a Reply