4 reasons plant-based milk will keep growing after the pandemic

A year ago, plant-based dairy was a hot trend that showed solid growth and promise for the future.Now, amid a pandemic, new innovation and an extremely popular newer entrant to the market, plant-based dairy is on fire. Since stay-at-home orders were issued in mid-March, sales have skyrocketed, spiking at 75.3% sales growth the week of March 15, and 58% total growth the week of March 22, according to statistics from SPINS.Sales have modulated somewhat, but the growth rate has stayed quite high across the segment, SPINS statistics show. In the first week of October, the growth rate had slowed to a still large 17.2%.And dairy alternatives are becoming more widespread. According to Mintel, four in 10 adults in the U.S. lives in a home where someone regularly uses them.The reasons for plant-based dairy’s pandemic success are varied, but analysts say that this trend is not going away any time soon.”I think that the long-term trajectory for plant based is not a fad. It is much more kind of a change in diet,” said Jeff Crumpton, a retail reporting manager at SPINS. “And I think it aligns to a lot of the diet tribes that we see, whether it’s a plant-based diet or a vegan diet.”Crumpton said that it’s highly likely plant-based milk will eventually make up the majority of the dairy category, but he could not guess how long it would take to get there. In 2019, according to statistics from the Plant Based Foods Association, plant-based alternatives made up 14% of the entire milk market. It had grown at a 5% clip in the year, compared to dairy milk’s essentially flat growth.At the end of this year, analysts will see just how much that has changed, but it’s apparent that the growth rate and market size already looks much different for plant-based dairy. Here are some of the reasons analysts say the growth will continue.While there is no sure-fire cure for COVID-19, millions of consumers have been taking their health into their own hands. They’re looking to eat ingredients that boost their immunity and support overall health. And many consumers see plant-based food as a clear nutritional winner. “It falls within this idea of food as medicine,” Crumpton said. “From a demographic standpoint, I think you have one segment that they understand it, they’ve tried it and they see this as a potential solution.”Karen Formanski, a Mintel health and nutrition analyst, wrote in an email that 39% of consumers use plant-based milks because they think they are healthier than dairy milk. While conventional milk

see just how much that has changed, but it’s apparent that the growth rate and market size already looks much different for plant-based dairy. Here are some of the reasons analysts say the growth will continue.While there is no sure-fire cure for COVID-19, millions of consumers have been taking their health into their own hands. They’re looking to eat ingredients that boost their immunity and support overall health. And many consumers see plant-based food as a clear nutritional winner. “It falls within this idea of food as medicine,” Crumpton said. “From a demographic standpoint, I think you have one segment that they understand it, they’ve tried it and they see this as a potential solution.”Karen Formanski, a Mintel health and nutrition analyst, wrote in an email that 39% of consumers use plant-based milks because they think they are healthier than dairy milk. While conventional milk has many positive nutritional aspects — including being rich in calcium and potassium and fortified with vitamin D — consumers often associate plant-based products with being better for them. In the annual IFIC Food and Health Survey released in June, 43% said that a product with a description of “plant-based” would likely be the most healthy one out of several options.Research has found that plant-based milk is not always the healthier beverage, though manufacturers are working now to add functional ingredients and more protein to the mix, Formanski wrote. Califia Farms released a Protein Oat line this year that adds pea protein and sunflower seeds to ma

has many positive nutritional aspects — including being rich in calcium and potassium and fortified with vitamin D — consumers often associate plant-based products with being better for them. In the annual IFIC Food and Health Survey released in June, 43% said that a product with a description of “plant-based” would likely be the most healthy one out of several options.Research has found that plant-based milk is not always the healthier beverage, though manufacturers are working now to add functional ingredients and more protein to the mix, Formanski wrote. Califia Farms released a Protein Oat line this year that adds pea protein and sunflower seeds to ma ke a product that’s comparable to the protein value of dairy milk, Formanski said. Even without adding functional ingredients, new varieties of plant-based milk are also bolstering the segment’s health halo. Oats are commonly marketed as being heart healthy, Formanski wrote, so consumers may automatically make the connection to oat milk also being good for the heart — even without any specific claims on the package.Consumers who pick up plant-based milk tend to want those higher nutritional values. According to Mintel, 38% of those who live in plant-based milk consuming households look for high protein claims. Almost half of adults want to see plant-based milk options with more protein.When consumers first ran to the grocery store in March to stockpile food and goods for an uncertain amount of time at home, they looked for items that could last on shelves for the long haul.Canned goods, dry pasta and freezer staples were cleared out, as were shelf-stable plant-based milks. While some plant-based milk products are in the refrigerated section of the store, more are available in center store. And, more importantly, many more plant-based milks are shelf stable than their dairy milk counterparts.Even if these consumers hadn’t tried plant-based milk before, Crumpton said, they were easily inclined to do so as they prepped their pantries.”They understand plant based. They’ve heard it enough,” Crumpton said. “They’re home, and so they’re cooking more. I think people get a bit more adventurous when they’re not able to kind of get out as much. And so they’re using food as a way to connect with their family. They’re not going to restaurants in as great a frequency as they would pre-pandemic. All of those things aid the top-line growth that we’re seeing for plant-based milks and dairy alternatives.”In a June report about the pandemic’s impact on plant-based dairy alternatives, Mintel found the alternative beverages helped consumers bring variety to their meals at home. This also helps them become familiar with the different plant-based options on the market today. After the pandemic, the firm concluded in the report, consumers are likely to keep the same plant-based milks in their refrigerators and pantries for the health benefits and to continue with the routines they have started.Plant-based milks are not necessarily catch-all substitutes for dairy milk, Crumpton said. Different milks have different taste profiles, mouthfeel and textures based on the crop they are made out of and the manufacturer. “It may be that I use almond milk with cooking in this certain way, but I’m going to use oat milk with my morning coffee,” he said.While plant-based milk has had great sales growth during the pandemic, oat milk has been a superstar.According to SPINS statistics, the grain-based beverage, which has only been widely consumed in the United States for a few years, is now the second most popular plant-based milk. The only plant-based dairy product that sells more is almond milk, which has been on top of the segment since 2013.Theiron sucrose vs ferric gluconate growth statistics on oat milk defy conventional trends. Oat milk sales represented a total of $213.35 million in the 52 weeks before Sept. 6 — an increase of 350.8% from a year ago for refrigerated varieties and 106.4% for shelf-stable products, according to SPINS statistics reported by Food Navigator. Between mid-March and the beginning of October, dollar sales of the beverage were up 212%, according to Nielsen. Crumpton said much of the meteoric rise of oat milk can be attributed to its taste profile, which is richer than many of the other plant-based milks that are on the market. Function is also important. Oatly, a player in the space since the 1990s, first entered the U.S. market through upscale coffee shops, being a non-dairy option for several cherished drinks. Formanski said the coffee shop channel continues to be important for oat milk brands.But, she said, it isn’t the only one.”Consumers state interest in trying oat mi

ke a product that’s comparable to the protein value of dairy milk, Formanski said. Even without adding functional ingredients, new varieties of plant-based milk are also bolstering the segment’s health halo. Oats are commonly marketed as being heart healthy, Formanski wrote, so consumers may automatically make the connection to oat milk also being good for the heart — even without any specific claims on the package.Consumers who pick up plant-based milk tend to want those higher nutritional values. According to Mintel, 38% of those who live in plant-based milk consuming households look for high protein claims. Almost half of adults want to see plant-based milk options with more protein.When consumers first ran to the grocery store in March to stockpile food and goods for an uncertain amount of time at home, they looked for items that could last on shelves for the long haul.Canned goods, dry pasta and freezer staples were cleared out, as were shelf-stable plant-based milks. While some plant-based milk products are in the refrigerated section of the store, more are available in center store. And, more importantly, many more plant-based milks are shelf stable than their dairy milk counterparts.Even if these consumers hadn’t tried plant-based milk before, Crumpton said, they were easily inclined to do so as they prepped their pantries.”They understand plant based. They’ve heard it enough,” Crumpton said. “They’re home, and so they’re cooking more. I think people get a bit more adventurous when they’re not able to kind of get out as much. And so they’re using food as a way to connect with their family. They’re not going to restaurants in as great a frequency as they would pre-pandemic. All of those things aid the top-line growth that we’re seeing for plant-based milks and dairy alternatives.”In a June report about the pandemic’s impact on plant-based dairy alternatives, Mintel found the alternative beverages helped consumers bring variety to their meals at home. This also helps them become familiar with the different plant-based options on the market today. After the pandemic, the firm concluded in the report, consumers are likely to keep the same plant-based milks in their refrigerators and pantries for the health benefits and to continue with the routines they have started.Plant-based milks are not necessarily catch-all substitutes for dairy milk, Crumpton said. Different milks have different taste profiles, mouthfeel and textures based on the crop they are made out of and the manufacturer. “It may be that I use almond milk with cooking in this certain way, but I’m going to use oat milk with my morning coffee,” he said.While plant-based milk has had great sales growth during the pandemic, oat milk has been a superstar.According to SPINS statistics, the grain-based beverage, which has only been widely consumed in the United States for a few years, is now the second most popular plant-based milk. The only plant-based dairy product that sells more is almond milk, which has been on top of the segment since 2013.Theiron sucrose vs ferric gluconate growth statistics on oat milk defy conventional trends. Oat milk sales represented a total of $213.35 million in the 52 weeks before Sept. 6 — an increase of 350.8% from a year ago for refrigerated varieties and 106.4% for shelf-stable products, according to SPINS statistics reported by Food Navigator. Between mid-March and the beginning of October, dollar sales of the beverage were up 212%, according to Nielsen. Crumpton said much of the meteoric rise of oat milk can be attributed to its taste profile, which is richer than many of the other plant-based milks that are on the market. Function is also important. Oatly, a player in the space since the 1990s, first entered the U.S. market through upscale coffee shops, being a non-dairy option for several cherished drinks. Formanski said the coffee shop channel continues to be important for oat milk brands.But, she said, it isn’t the only one.”Consumers state interest in trying oat mi lk not only as a beverage addition, but also as a stand-alone beverage, with cereal and as a cooking/baking ingredient,” Formanski wrote.Ecologically minded consumers also consider oat milk as one of the most sustainable plant-based milk options . Oats are a beneficial rotational crop, use little water, tend to make fields less habitable for weeds and provide erosion control, according to the North American Millers Association.Almonds, on the other hand, are a water-intensive crop. According to Mintel, one in five adults thinks almond milk production is bad for the environment. Formanski wrote this percentage is even higher for consumers between 18 and 44.Although consumers love almond milk, Crumpton said sustainability issues may force them to reconsider their choices. “What happens when climate change starts to affect the almond supply in California?” Crumpton asked. “You have brands that are always kind of dipping their toe to understand what sustainability feels like, because, again, that’s really core to what a natural

lk not only as a beverage addition, but also as a stand-alone beverage, with cereal and as a cooking/baking ingredient,” Formanski wrote.Ecologically minded consumers also consider oat milk as one of the most sustainable plant-based milk options . Oats are a beneficial rotational crop, use little water, tend to make fields less habitable for weeds and provide erosion control, according to the North American Millers Association.Almonds, on the other hand, are a water-intensive crop. According to Mintel, one in five adults thinks almond milk production is bad for the environment. Formanski wrote this percentage is even higher for consumers between 18 and 44.Although consumers love almond milk, Crumpton said sustainability issues may force them to reconsider their choices. “What happens when climate change starts to affect the almond supply in California?” Crumpton asked. “You have brands that are always kind of dipping their toe to understand what sustainability feels like, because, again, that’s really core to what a natural

-

Ammonia Ferric Citrate

Read more -

Beverage Series

Read more -

Calcium Carbonate

Read more -

Calcium Citrate

Read more -

Calcium Citrate Granules

Read more -

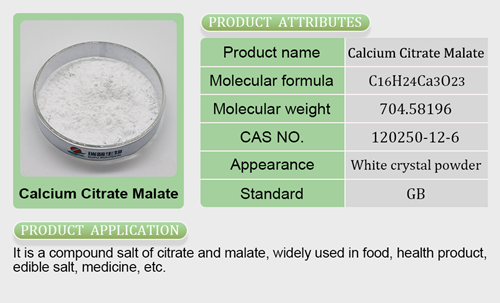

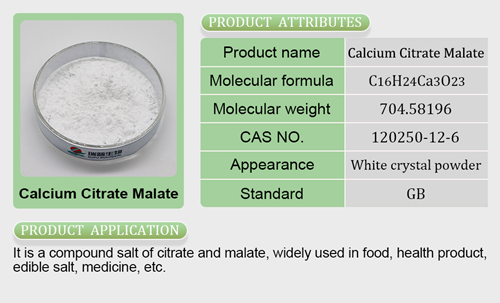

Calcium Citrate Malate

Read more -

Calcium Gluconate

Read more -

Calcium Lactate

Read more -

Calcium Lactate Gluconate

Read more -

Cereal/ Meal Replacement /Food Series

Read more -

Compound nutritional fortifier (Biotin dilution)

Read more -

Compound nutritional fortifier (VB12 dilution)

Read more -

Copper Gluconate

Read more -

Ferric Phosphate

Read more -

Ferric Pyrophosphate

Read more -

Ferric Sodium Edetate

Read more -

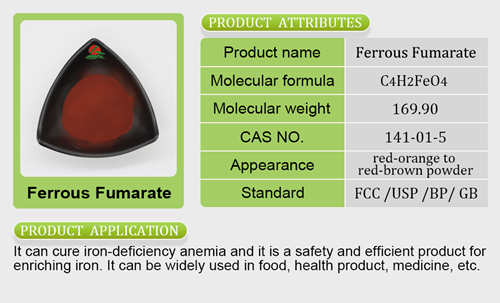

Ferrous Fumarate

Read more -

Ferrous Gluconate

Read more -

Ferrous Lactate

Read more -

Magnesium Carbonate Granules

Read more -

Magnesium Citrate

Read more -

Magnesium Citrate Granules

Read more -

Magnesium Gluconate

Read more -

Magnesium Lactate

Read more -

Magnesium Lactate Granules

Read more -

Manganese Gluconate

Read more -

Milk Powder Series

Read more -

Monosodium Fumarate

Read more -

Potassium Chloride

Read more -

Potassium Citrate

Read more -

Potassium Malate

Read more -

Sodium Malate

Read more -

Special Diet Series

Read more -

Supermicro Ferric Pyrophosphate

Read more -

Supermicro Zinc Citrate

Read more -

Zinc Citrate

Read more -

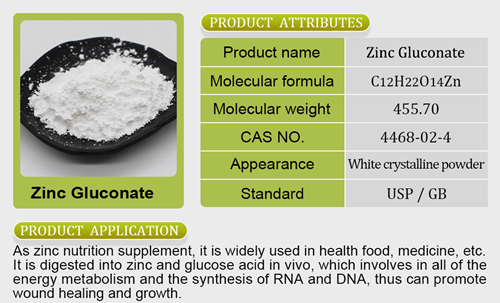

Zinc Gluconate

Read more -

Zinc Gluconate Granules

Read more -

Zinc Lactate

Read more

lant proteins the beverage was made from, but its creamy texture, ability to froth and smooth performance in a cup of hot coffee were showcased.”Impossible Foods … [has] done a really good job of communicating plant based [meat] to the broadest segment of the population,” Crumpton said. “… I’m not surprised that they’re working on milk, and the fact that they’re working on a product that kind of behaves and tastes and feels and smells very similar to a dairy milk means they are going for the same types of customers.”Impossible isn’t the only player that is set to shake up plant-based dairy. South American plant-based powerhouse NotCo, which recently raised $85 million to expand to the United States, started selling NotMilk in Whole Foods Markets nationwide earlier this month. NotCo uses sophisticated algorithms to determine the protein composition to make plant-based substitutes that are like the real thing. NotMilk contains pea protein, as well as chicory root fiber, pineapple juice concentrate and cabbage juice concentrate.There are still other nuts and grains that are being transformed into new plant-based milk alternatives. Pistachio, pecan, hemp and cashew milks are on the magnesium malate absorption ratemarket, as well as new combinations of nuts, grains and proteins. Different flavors are being added to plant-based milks as well, providing a true diversity to what consumers are drinking. Crumpton said that no matter how innovative or how close to dairy milk new products like the one from Impossiblzinc gluconate safe for dogse Foods will be, it will not detract from the market share or creativity of some of the other options coming on line. Consumers seem to be excited about new opthorne magnesium citratetions in plant-based milk, and continue to buy more of it.”I think it gives a brand doing some R&D in that space a deep bench to kind of pull from, so tis ferrous fumarate good for anemiahey could have a portfolio that has a little bit of all of them [flavors and ingredients],” Crumpton said. “And consumers, they still get the richness of all of the different flavor profiles. We see that, from an innovation standpoint, the segment grows, as opposed to replacing another product.”

lant proteins the beverage was made from, but its creamy texture, ability to froth and smooth performance in a cup of hot coffee were showcased.”Impossible Foods … [has] done a really good job of communicating plant based [meat] to the broadest segment of the population,” Crumpton said. “… I’m not surprised that they’re working on milk, and the fact that they’re working on a product that kind of behaves and tastes and feels and smells very similar to a dairy milk means they are going for the same types of customers.”Impossible isn’t the only player that is set to shake up plant-based dairy. South American plant-based powerhouse NotCo, which recently raised $85 million to expand to the United States, started selling NotMilk in Whole Foods Markets nationwide earlier this month. NotCo uses sophisticated algorithms to determine the protein composition to make plant-based substitutes that are like the real thing. NotMilk contains pea protein, as well as chicory root fiber, pineapple juice concentrate and cabbage juice concentrate.There are still other nuts and grains that are being transformed into new plant-based milk alternatives. Pistachio, pecan, hemp and cashew milks are on the magnesium malate absorption ratemarket, as well as new combinations of nuts, grains and proteins. Different flavors are being added to plant-based milks as well, providing a true diversity to what consumers are drinking. Crumpton said that no matter how innovative or how close to dairy milk new products like the one from Impossiblzinc gluconate safe for dogse Foods will be, it will not detract from the market share or creativity of some of the other options coming on line. Consumers seem to be excited about new opthorne magnesium citratetions in plant-based milk, and continue to buy more of it.”I think it gives a brand doing some R&D in that space a deep bench to kind of pull from, so tis ferrous fumarate good for anemiahey could have a portfolio that has a little bit of all of them [flavors and ingredients],” Crumpton said. “And consumers, they still get the richness of all of the different flavor profiles. We see that, from an innovation standpoint, the segment grows, as opposed to replacing another product.”

Leave a Reply